is colorado a community property state for tax purposes

How Your States Community Property Laws Can Affect Your Tax Returns. The Best Is Colorado A Community Property State For Tax Purposes Ideas.

States Without Sales Tax Article

Colorado is an equitable distribution or common law state rather than a community property state.

. Certification of Levies and Revenues by County. Colorado does not currently impose a property tax for state purposes see Colorado Dept. Apply community property laws to what is referred to as the marital estate The marital estate is a term used to describe all of the liabilities and assets tha If you are facing the possibility of divorce in Colorado you may feel overwhelmed by the emotional and financial challenges that come with such a.

For income tax purposes if spouses file separate returns each spouse is taxed on 50 of the total community property income regardless of which spouse acquired the income. Thus each spouse gets an equal division of marital assets in the event of death or divorce. The Exemptions Section is responsible for determining qualification for exemption from property taxation for properties that are owned and used for religious charitable and private school purposes.

Income of a nonresident individual for purposes of Colorado income tax. It disregards their individual income or earnings. Community property law is a form of property ownership which dates back to the year 693 in Visigothic Spain.

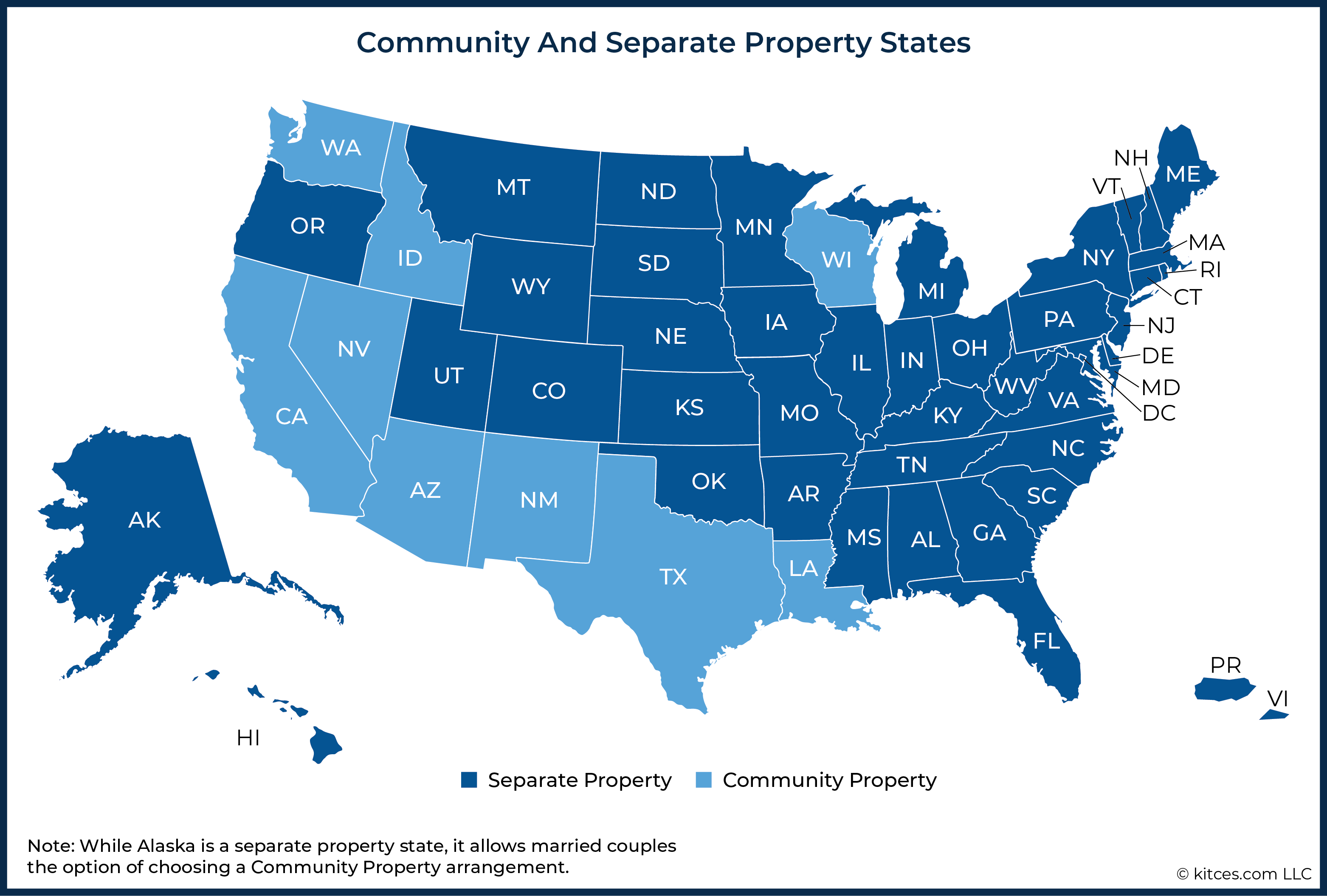

These states are Arizona California Idaho Louisiana Nevada New Mexico Texas Washington and Wisconsin. Married couples who live in community property states jointly own their marital property assets and income. Remember that the way this expense is calculated in Colorado can be vastly different from other states.

Local rates What is. Only nine states in the US. That means the value of a tax is determined by the price of the transaction or property.

It assumes that spouses contribute equally to their marriage. Colorado is not a community property state as courts do not assume that the property obtained during the course of a marriage is all marital property. Thus as a general rule each spouse owns and is taxed upon the income that he or she earns.

That means marital property isnt automatically assumed to be owned by both parties. Currently exempt property owners are required to file annual reports with the DPT in order to continue exemption. How Is Marital Property Divided in a Colorado Divorce.

Property tax is known as an ad valorem. Its your spouses income as much as it is yours if you earn 80000 a year for example. Likewise your spouse is legally obligated to repay a 100000 debt even if.

Of Local Affairs 2013 Annual Report. Colorado is not a community property state but it does have a category called marital property in colorado most assets acquired during a marriage are considered marital property which is subject to division by the courts in a divorce. The state income tax addback.

Is Colorado a Community Property State for Tax Purposes In some states the conjugal union ends when the spouses separate permanently even if. Common law is the dominant property system in the United States. Colorado is an equitable distribution state which means property will be divided by the court in a manner that is deemed fair to both parties but not necessarily equal if spouses cannot come to a resolution on their own.

First installment of tax bill due. Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone. Colorado is a common law state not a community property state which means that each spouse is a separate individual with separate legal and property rights.

Its considered a separate property or equitable distribution state. 5 rows Is Colorado a Community Property State for Tax Purposes In some states the conjugal union ends. As many of our readers know Colorado is not a community property state when it comes to divorce.

Nine states have community property laws that govern how married couples share ownership of their incomes and property. These laws have a significant impact on their tax situations. Colorado does not currently impose a property tax for state purposes see Colorado Dept.

As it relates to separate tax returns filed by married individuals domiciled in a community property state federal income tax is assessed on 100 of a taxpayers. Colorado does not currently impose a property tax for state purposes see Colorado Dept. Payment of Withholding Tax on Certain Colorado Real Property Interest Transfers.

Essentially your property tax depends on the current market value. Is Colorado A Community Property State For Tax Purposes The qualified investment in used property is limited to 150000 per year and any amounts expensed under section 179 of The llc is wholly owned by the husband and wife as community property.

Where Are Americans The Happiest Vivid Maps

Property Taxes Property Tax Analysis Tax Foundation

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Model Homes Archive Lake Ashton

Is Colorado A Community Property State Johnson Law Group

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

States With The Highest And Lowest Property Taxes

How Do State And Local Sales Taxes Work Tax Policy Center

Community Property States List Vs Common Law Taxes Definition

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting

State Taxation As It Applies To 1031 Exchanges

Property Tax Comparison By State For Cross State Businesses

Community Property States List Vs Common Law Taxes Definition

Which States Are Community Property States In Divorce

Property Taxes Property Tax Analysis Tax Foundation

Using Gifting Between Spouses To Maximize Step Up In Basis

:max_bytes(150000):strip_icc()/community-property-states-3193432_color-fc6662865d234709b76fe67cce591897.png)

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)